BC Government Offers Interest-Free Loans to First Time Home Buyers

If you are thinking of buying your first home and you live in BC, then you should be aware of the Home Owner Mortgage and Equity Partnership, a new loan program from the Provincial Government. In a nutshell, they will loan you some money for your down payment.

What are they looking for in exchange? Probably your vote.

Not everyone qualifies, there are limits, and it won’t last forever. This article sums up what you need to know if it’s good for you and if it’s good for the province.

Cole’s Notes on the New Down Payment Loan Program

- Loans up to 5% of the home or $37,500

- 25-year loans with no interest payments for the first 5 years

- Only being offered for 3 years

- You can’t make too much money or be buying too expensive of a house

Who Qualifies

To qualify for the new program you must:

- Be a first-time homebuyer

- Have less than $150,000 in pre-tax household income

- A Canadian citizen or Permanent Resident for at least 5 years, having lived in BC for at least 12 months

- Be buying a home that is less than $750,000

- Use the property as your principal residence for at least 5 years

- Use a minimum Loan-to-Value (LTV) of 80% (maximum combined down payment of 20%)

- Have saved your own down payment at least equal to the value of the loan

The loan is targeted at middle-income families with stable incomes that have not been able to save up a large enough down payment.

We emphasize “stable” here for a reason. The program only stipulates that you can’t make more than $150,000. It does not enforce a minimum income level or require a certain type of income (salaried vs. self-employment. HOWEVER, you still have to qualify for a mortgage from your bank and they may be more hesitant if you have less skin in the game (didn’t contribute all of the down payment).

That being said, you may already have 5% or more saved up and only plan to use the new down payment loan to save money on interest payments and CMHC fees.

So, if you already have your down payment saved up, how much can you save by using the new Loan Program?

If you don’t have enough of a down payment, but you can otherwise qualify for the mortgage and you meet the requirements of the new program, how expensive of a home can you buy?

What the New Home Loan Program Could Mean for You

If you qualify for the program and you are in the market for a home, then this can mean one of two things: 1 you now afford to buy a home that you previously could not; or 2 you can save money on the same home purchase

#1 – How Expensive of a Home Can You Afford to Buy Using the Down Payment Loan Program

Let’s say you intend to use the new loan program to buy a more expensive house, rather than save money on the one you were intending to buy. Let’s further suppose that you qualify for your mortgage and for the loan program.

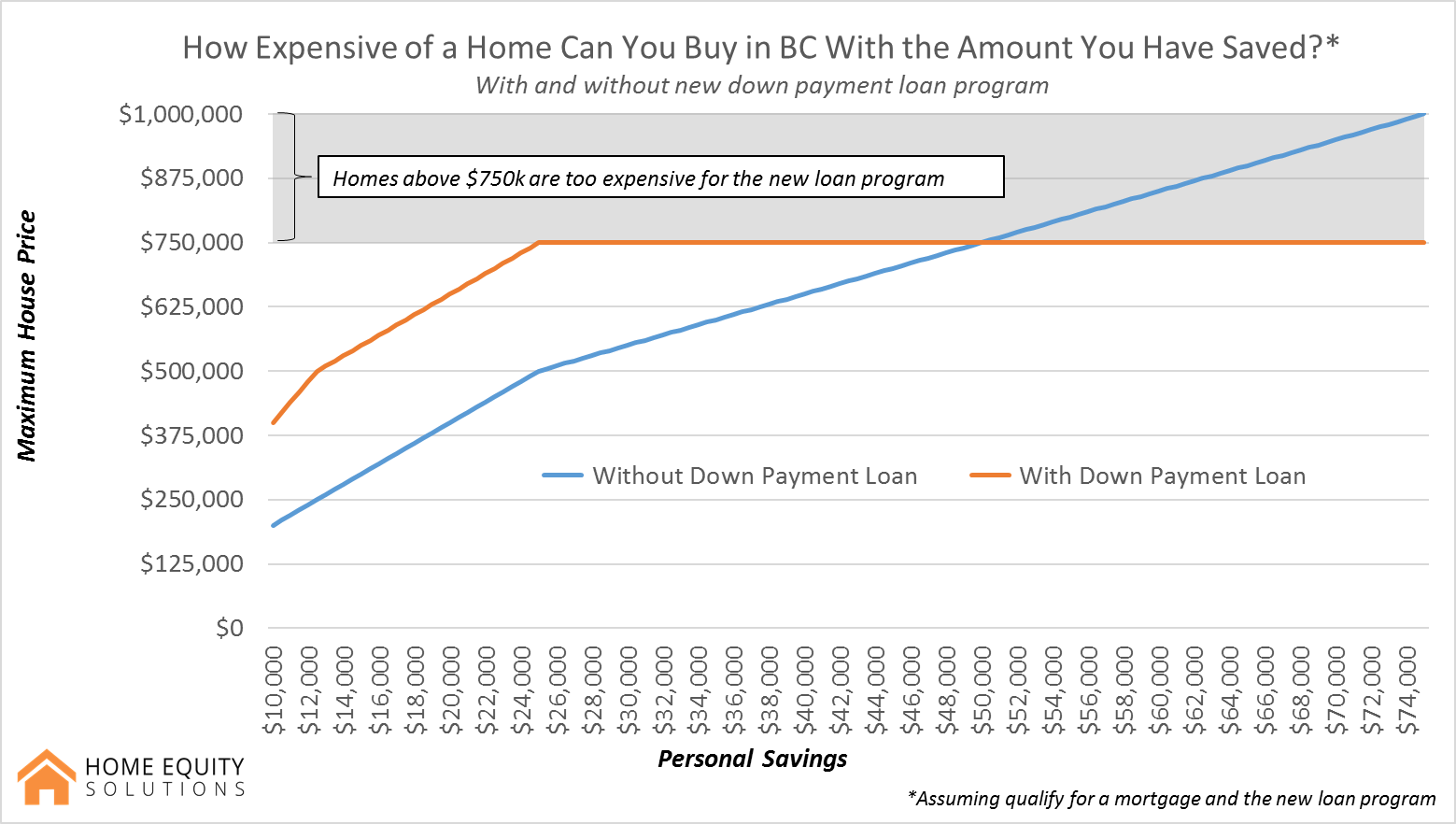

The graph below explains:

- If you currently have $10,000 saved up, the most expensive home you could afford would be $200,000

- Using the Provincial Government’s new loan program, you could double your down payment and buy a $400,000 home

- Without the loan program, you would need $50,000 saved to buy a $750,000 home

- With the loan program, you would only need $25,000 to purchase that same home

#2-How Much Can You Save by Using the New Loan Program to Buy the SAME Home?

The loan saves you money through 2 compounding effects: 1 A higher down payment means that pay a lower CMHC fee (if you buy a home for less than 20% you have to pay an insurance fee of 2.4% to 3.6% that is added onto your mortgage) 2 A lower CMHC fee and a larger down payment mean you have a smaller effective mortgage, which means your payments are less each month (you still owe the Province, but you don’t pay interest for the first 5 years) The graph below shows the total savings of these two forces over the 5 years, interest-free period of the new loan program:

- On a $250,000 home, you save around $5,500 over the 5 year period

- You save upwards of $15,500 on a $750,00 home (the most expensive one you can get a down payment loan for)

Should You Use the New Program?

If you were already going to buy a home, then absolutely.

Give it some careful thought if you are on the fence, though.

What the New Loan Program Means for the Province

On the whole, this isn’t the best policy for the Provincial Government as it mostly pushes the problem further down the road and ignores its root causes by focusing on demand, rather than supply. However, it will help some buyers get into the market and while they anticipate loaning out $700 to $750 million, they will get the vast majority of it back (though without interest).

Over the 3 years of the program, the loans will certainly prop up demand for apartment and condos and the Greater Vancouver Area and single-detached houses elsewhere among first-time homebuyers. However, boosting demand with financial measures will also push up prices, eroding some of the intended affordability benefits.